SEBI vide its Master circulars dated July 31, 2023, August 4, 2023 & December 28, 2023 has

streamlined the existing dispute resolution mechanism in the Indian securities market by

establishing a common Online Dispute Resolution Portal (“ODR Portal”) which harnesses online

conciliation and online arbitration for resolution of disputes arising in the Indian Securities Market.

An investor/client shall first take up his/her/their grievance with the Market Participant

by lodging a complaint directly with the concerned Market Participant. If the grievance is

not redressed satisfactorily, the investor/client may, in accordance with the SCORES guidelines,

escalate the same through the SCORES Portal in accordance with the process laid out therein.

After exhausting these options for resolution of the grievance, if the investor/client is still

not satisfied with the outcome, he/she/they can initiate dispute resolution through the ODR Portal.

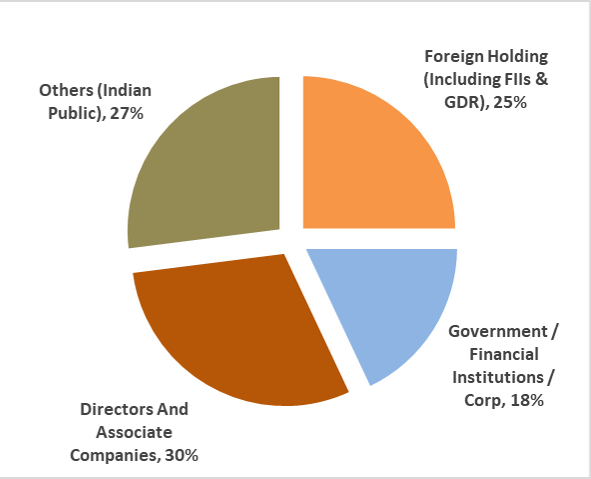

Shareholding Pattern as on December 31, 2024

| Details | Percentage Holding | |

|---|---|---|

| Foreign Holding (Including FIIs & GDR) | 25 | |

| Government / Financial Institutions / Corp | 18 | |

| Directors And Associate Companies | 30 | |

| Others (Indian Public) | 27 | |

| Total | 100 |

| Year | Interim Dividend (INR per share) |

Final Dividend (INR per share) |

Total Dividend* (INR Million) |

Dividend Payout ratio (%) | |

|---|---|---|---|---|---|

| 2024-25 | 9.00

7.20 8.10 |

||||

| 2023-24 | 5.40

7.50 6.30 6.30 10.80 |

5182.4 | 19.82% | ||

| 2022-23 | 5.40

7.20 7.20 9.00 |

4111.6 | 15.97% | ||

| 2021-22 | 4.50

5.40 |

1432.3 | 23.03% | ||

| 2020-21 | 9.00 | 1322.7 | 12.84% | ||

| 2019-20 | 5.40

2.70 |

1291.3 | 46.00 | ||

| 2018-19 | 5.40 | 933.6 | - | ||

| 2017-18 | 7.20 | 1260.8 | 78.71 | ||

| 2016-17 | 3.60 | 6.50 | 1785.4 | 30.00 | |

| 2015-16 | 6.00

7.50 |

2439.5 | 40.00 | ||

| 2014-15 | 4.00 | 7.00 | 1934.4 | 61.25 | |

| 2013-14 | 4.00 | 5.00 | 1587.7 | 77.57 | |

| 2012-13 | 3.00 | 4.50 | 1298.6 | 88.79 | |

| 2011-12 | 3.00 | 3.50 | 1139.8 | 79.52 | |

| 2010-11 | 3.50 | 4.50 | 1354.3 | 51.95 | |

| 2009-10 | 8.00 | 1407.9 | 35.57 | ||

| 2008-09 | 2.50

2.50 3.00 |

1425.4 | 10.29 | ||

| 2007-08 | 4.00

3.50 5.00 2.50 |

2672.3 | 19.70 | ||

| 2006-07 | 3.00

4.00 |

4.50 | 2017.1 | 22.83 | |

| 2005-06 | 3.50

2.50 4.00 |

1948.5 | 23.23 | ||

| 2004-05 | 3.50

2.50 |

3.00 | 1942.4 | 24.10 | |

| 2003-04 | 2.50 | 4.00 | 1395.6 | 30.20 | |

| 2002-03 | 4.00 | 858.1 | 37.78 | ||

| 2001-02 | 4.00 | 761.8 | 37.17 | ||

| 2000-01 | 2.75 | 665 | 37.48 | ||

| 1999-00 | 1.50 | 430.9 | 39.01 | ||

| 1998-99 | 2.00 | 638.4 | 50.49 | ||

| 1997-98 | 2.50 | 1.50 | 1265.3 | 77.04 | |

| 1996-97 | 3.00 | 948.93 | 69.56 | ||

| 1995-96 | 2.00 | 575 | 37.73 | ||

| 1994-95 | 2.30 | 607.4 | 35.38 | ||

| 1993-94 | 2.30 | 412.4 | 30.15 | ||

| 1992-93 | 3.25 | 310.2 | 28.46 | ||

| 1991-92 | 3.05 | 261 | 27.84 | ||

| 1990-91 | 2.40 | 171.2 | 46.08 | ||

| 1989-90 | 2.00 | 136.1 | 34.16 | ||

| 1988-89 | 1.20 | 66.8 | 29.37 | ||

| 1988-89 | 1.20 | 66.8 | 29.37 | ||

| 1987-88 | 1.50 | 83.3 | 50.70 | ||

| 1986-87 | 1.25 | 52.8 | 77.64 | ||

| 1985-86 | 1.20 | 37 | 52.31 | ||

| 1984-85 | 0.70 | 17.9 | 94.27 | ||

| 1983-84 | - | - | - | ||

| 1982-83 | - | - | - | ||

| 1981-82 | 1.00 | 25.6 | 57.29 | ||

| 1980-81 | 2.00 | 30.7 | 17.90 | ||

| 1979-80 | 2.50 | 38.3 | 24.25 | ||

| 1978-79 | - | - | - | ||

| 1977-78 | - | - | - | ||

| 1976-77 | 1.50 | 19.2 | |||

| 1975-76 | 2.00 | 19.2 | 16.36 | ||

| 1974-75 | 3.60 | 35.5 | 31.60 | ||

| 1973-74 | 1.20 | 11.5 | 31.99 | ||

| 1972-73 | 2.50 | 12 | 27.89 | ||

| 1970-71 | 2.25 | 10.8 | 31.02 | ||

| 1969-70 | 1.20 | 5.8 | 54.35 | ||

| 1968-69** | 2.50 | 6 | 25.60 | ||

| 1967-68** | 2.00 | 4.8 | 22.00 | ||

| 1966-67** | 2.00 | 3.6 | 20.36 | ||

| 1965-66** | 1.60 | 2.5 | 18.80 | ||

| 1964-65** | 1.10 | 1.7 | 52.63 | ||

| 1963-64** | 1.08 | 1.2 | 46.00 | ||

| 1962-63** | - | - | - | ||

| 1961-62** | 1.00 | 0.9 | 73.00 | ||

| 1960-61** | 0.78 | 0.7 | 57.59 | ||

| 1959-60** | 1.00 | 0.9 | 27.39 | ||

| 1958-59** | 1.50 | 1.4 | 42.75 | ||

| 1957-58** | 1.80 | 1.6 | 24.90 | ||

| 1956-57** | 1.50 | 1.1 | 18.60 | ||

| 1955-56** | 1.50 | 0.9 | 34.00 | ||

| 1954-55** | - | - | - | ||

| 1953-54** | 1.00 | 0.5 | 54.90 | ||

| 1952-53** | 1.00 | 0.4 | 48.20 | ||

| 1951-52* | 1.00 | 0.2 | 30.00 | ||

| 1950-51** | 1.00 | 0.2 | 26.80 | ||

| 1949-50** | 1.00 | 0.2 | 16.00 | ||

| 1949-50** | 0.50 | 0.1 | 48.00 |

* Including dividend distribution tax

** Year ending June 30

| Year | Bonus Shares Issue | |

|---|---|---|

| FY1951-52 | (1:2) | |

| FY1955-56 | (1:5) | |

| FY1963-64 | (1:4) | |

| FY1965-66 | (1:5) | |

| FY1967-68 | (1:3) | |

| FY1969-70 | (1:1) | |

| FY1973-74 | (1:1) | |

| FY1977-78 | (3:5) | |

| FY1981-82 | (2:3) | |

| FY1990-91 | (1:5) |

| Year | Rights Issue | |

|---|---|---|

| FY1952-53 | (2:3) | |

| FY1956-57 | (1:1) | |

| FY1986-87 | (2:3) | |

| FY1991-92 | (1:1) | |

| FY1993-94 | (2:5) |

Kindly Note: (1:2) Its read as one bonus share issued for every 2 shares held by shareholders

Share Buyback

| Year | No. of Equity Shares bought back* |

Average Acquisition Price (L)** |

Total Amount (INR Crores)** | |

|---|---|---|---|---|

| FY2000-01 | 4,29,40,921 | 34.91 | 149.99 | |

| FY2001-02 | 2,55,94,168 | 28.27 | 72.36 | |

| FY2013-14 | 15,45,019 | 267.14 | 41.27 | |

| FY2019-20 | 38,10,581 | 261.60 | 99.99 | |

| FY2021-22 | 41,99,323 | 317.26 | 133.23 |

* No of equity shares bought back includes physical shares, pending delivery.

In the event of bad delivery, the number of shares bought back may undergo a change.

** Includes transaction costs including brokerage costs, securities transaction taxes, service tax, and stamp duty.

NON CONVERTIBLE DEBENTURES (Current)

| Type of Bond | Issue Date | Marutity Date | Coupon | Tenure (Yrs) |

Amount Issued (INR Cr) |

Amount Bought Back (INR Cr) |

Current O/S Amount (INR Cr) |

|

|---|---|---|---|---|---|---|---|---|

| Secured | 02 Nov 2020 | 02 Nov 2028 | 8.05% | 8 | 150 | - | 150 | |

| Secured | 12 Apr 2018 | 12 Apr 2028 | 8.85% | 10 | 300 | - | 300 | |

| Unsecured | 25 May 2017 | 25 May 2027 | 8.25% | 10 | 150 | - | 150 | |

| Unsecured | 10 Nov 2016 | 10 Nov 2026 | 8.24% | 10 | 200 | - | 200 | |

| Unsecured | 10 Nov 2016 | 10 Nov 2025 | 8.24% | 9 | 200 | - | 200 | |

| Unsecured | 31 May 2016 | 31 May 2025 | 8.70% | 9 | 250 | - | 250 | |

| Unsecured | 06 May 2016 | 06 May 2026 | 8.70% | 10 | 250 | - | 250 | |

| Total | 1500 |

NON CONVERTIBLE DEBENTURES (Matured)

| Type of Bond | Issue Date | Marutity Date | Coupon | Tenure (Yrs) |

Amount Issued (INR Cr) |

Amount Bought Back (INR Cr) |

|

|---|---|---|---|---|---|---|---|

| Unsecured | 10 Nov 2009 | 10 Nov 2019 | 9.60% | 10 | 200 | - | |

| Unsecured | 02 Feb 2011 | 02 Feb 2021 | 9.70% | 10 | 100 | - | |

| Unsecured | 25 Apr 2011 | 25 Apr 2021 | 9.70% | 10 | 50 | - | |

| Unsecured | 15 Apr 2011 | 15 Apr 2021 | 9.70% | 10 | 150 | - | |

| Unsecured | 06 Jan 2011 | 06 Jan 2023 | 9.70% | 12 | 100 | - | |

| Unsecured | 18 Jan 2011 | 18 Jan 2023 | 9.70% | 12 | 100 | - | |

| Unsecured | 18 Jan 2017 | 18 Jan 2024 | 7.99% | 7 | 250 | - | |

| Secured | 31 Aug 2017 | 31 Aug 2024 | 8.05% | 7 | 150 | - | |

| Unsecured | 18 Jan 2017 | 18 Jan 2025 | 7.99% | 8 | 250 | - | |

| Unsecured | 20 Aug 2009 | 20 Aug 2019 | 9.75% | 10 | 250 | 15 | |

| Unsecured | 06 Jan 2010 | 05 Jan 2018 | 9.40% | 8 | 100 | - | |

| Unsecured | 08 Feb 2010 | 08 Feb 2018 | 9.35% | 8 | 100 | 15 | |

| Unsecured | 24 Dec 2009 | 24 Dec 2018 | 9.19% | 9 | 100 | - | |

| Unsecured | 06 Jan 2010 | 06 Jan 2019 | 9.40% | 9 | 50 | - | |

| Unsecured | 06 Jan 2010 | 06 Jan 2019 | 9.40% | 9 | 50 | 10 | |

| Unsecured | 08 Feb 2010 | 08 Feb 2019 | 9.35% | 9 | 100 | 15 | |

| Secured | 03 Jul 2009 | 03 Jul 2019 | 9.80% | 10 | 250 | 10 |

FY-2025

FY-2025

CY-2025

CY-2025